2021 is a year of violent ups and downs for business and large companies.

The epidemic continues, and the global supply chain is somewhat fragmented and under tremendous pressure. A ship stuck in the Suez Canal can actually block the logistics of the global economy.

Omi Keron, which struck at the end of the year, brought global epidemic prevention back to tension and blockade.

We all say that a company that can go through the cycle will be an excellent company. Now, it must pass through the epidemic, and even through some artificial technological and economic separation and barriers.

In Jiemian News’s 2021 list of the most beautiful companies, we have paid attention to some outstanding companies that travel through cycles and uncertainties.

China’s new energy automobile industry chain is the highlight throughout the year.

Ningde Times, the world’s largest supplier of new energy batteries, once exceeded 1.6 trillion yuan in market value, becoming the second largest company in the A stock market, second only to Kweichow Moutai.

BYD launched a new lithium iron phosphate “blade battery”. Its annual sales of vehicles including new energy vehicles exceeded 500,000, a year-on-year increase of more than twice. The company’s market value is second only to Tesla and Toyota Motor, and ranks among the top three global listed auto companies by market value.

Ganfeng Lithium, Northern Rare Earth, China Shenhua, and Baosteel Co., Ltd. ushered in a wave of super cycles. The explosion of demand for new energy vehicles has pushed up the prices of rare metals such as lithium and cobalt in the upstream of the industrial chain. The gap in the semiconductor industry has also increased the valuation of rare earth and other minerals. The Fed’s massive quantitative easing, the continued depreciation of the U.S. dollar, and global resource-based product prices continue to rise. Iron and steel, coal, petroleum, rare non-ferrous metals, and natural gas have all ushered in a good period of prosperity.

Kexing is one of the few companies that received positive feedback during the epidemic. It has become the world’s largest manufacturer of new crown vaccines in supply and usage, and its annual profit level will reach 100 billion yuan.

Jitu and SAIC-GM-Wuling are both in an over-competitive market, and they are good at creating opportunities and profits when they are impossible.

In the field of new consumption, this is a year of the rise of domestic products. Sports brand Anta seized the opportunity and once surpassed Adidas in market value.

The rise of Oriental Wealth has once again shown the huge potential of Internet channels to the market. Since the end of June 2021, its total market value has surpassed the securities industry’s “leading” CITIC Securities, and has been firmly on the top of the brokerage list ever since.

Judging from the Jiemian News 2021 list of the most frustrated companies, this is also a very harsh year for some large companies.

Some large white horse companies in the traditional sense even felt the chill. SF Express, the former “king of express delivery,” fell to the altar, and suffered a quarterly loss in the first quarter for the first time. Its market value fell by nearly 50% from its peak throughout the year.

Haidilao, an iconic company in China’s catering industry, has truly fallen to the bottom of the sea and closed its stores drastically. It is paying for the mistakes it made. The sudden drop in passenger flow caused by the epidemic is not the root cause of Haidilao’s decline, but it has magnified many of Haidilao’s problems.

Education and training companies are also greatly affected by the macro environment. The 18-year-old Good Future ushered in the cruelest coming-of-age ceremony. Under the sudden turn of the industry, the market value of the future has evaporated by more than 350 billion yuan, almost to zero.

The “first share of Chinese e-cigarette brand” Fogcore Technology is also in the turmoil of e-cigarette regulatory policies, and now the market value is only about one-tenth of what it was when it was first listed at the beginning of the year.

The “blind diversification” made by some big companies when the year is good has now become a trap. Suning was once China’s largest commercial chain enterprise, but it turned to a turning point in its liquidity crisis. Evergrande, which rushed to the top of the real estate industry, fell into a crisis due to its infinite diversification expansion.

Some Internet leading companies are also facing tremendous pressure from platform anti-monopoly, and their performance is not as good as expected. IQiyi has laid off nearly 30% of its employees; a year after Ant Group’s IPO collapsed, Didi still “delisted from the New York Stock Exchange and launched a Hong Kong listing” for compliance rectification; the fast-growing super unicorn ByteDance also pressed The brake button will lay off employees in education, gaming, and commercial platform businesses.

Cycle and uncertainty are neutral words. Some companies may be knocked down by it, but more companies will follow suit. SAIC-GM-Wuling’s Wuling Hongguang MINI EV new energy model has accumulated sales of 328,000 units, ranking second in the world, second only to Tesla Model 3, and Polar Rabbit also grabbed from the “one piece” market of SF Express and Four Links. Arrived in a piece of market space of its own. The innovative power of products and business models cannot be underestimated.

Business is still full of imagination. Facebook changed its name to Meta. Although the real estate speculation in the original universe is a bit exaggerated, Louis Vuitton (LV) really launched its own NFT digital doll. The future is worth looking forward to.

Jiemian News once again conducts annual company inventory, launching the most beautiful companies in 2021 and the most disappointed companies in 2021, presenting readers with important memories in the financial sector in the past year.

1. CATL: The market value has increased by 800 billion in one year

On May 31, 2021, CATL broke through one trillion market value for the first time, ranking tenth on the A stock market value list. At the beginning of December, the market value of CATL once exceeded 1.6 trillion yuan, becoming the second largest company in the A stock market, second only to Kweichow Moutai.

In just one year, the market value of CATL has risen rapidly by 800 billion yuan. This company, which was once self-deprecated as a Zhangwan battery factory by its internal employees, also has such a resounding nickname as “Ningwang” and “Battery Mao”.

Of course, for the CATL, the uncertainty brought about by multiple technical routes of new energy batteries is still a challenge. The technology of sodium-ion batteries, solid-state batteries, and semi-solid-state batteries is evolving rapidly. Competitors such as BYD and AVIC Lithium Battery are gradually eroding customers and market shares in the Ningde era.

2. BYD: New energy vehicle industry chain harvester

At the beginning of this year, BYD announced the start of a bid change for its passenger cars. This 21-year-old Chinese local car brand officially started the brand’s upward campaign. Under the leadership of BYD’s flagship model-Han, BYD’s original lithium iron phosphate “blade battery” began to be installed and deployed. According to statistics, the total installed capacity of BYD’s new energy vehicle power batteries and energy storage batteries this year is about 32.873GWh, ranking second in the industry.

Not only that, starting from the end of the first quarter of this year, models based on BYD’s “DM-i Super Hybrid” system have become more popular, and the end market is still hard to find. According to data, in the past November, BYD’s new energy vehicle sales accounted for over 90%, reaching 90,121 units, a sharp increase of 252.7% year-on-year. As of November this year, BYD’s annual sales exceeded 500,000 vehicles, a year-on-year increase of 230.7%.

The improvement of the business level has also enabled BYD’s market value to rise steadily this year. As of a few days ago, BYD’s market value has risen to 833.2 billion yuan, close to the trillion yuan mark. The company’s market value is second only to Tesla and Toyota Motor, and ranks among the top three global listed auto companies by market value.

It is understood that BYD will also launch its high-end brands in the first half of next year, and its first model will reach a price range of 500,000-1 million.

3. Orient Wealth: A new brokerage firm whose market value surpasses CITIC Securities

At the end of June 2021, the total market value of Oriental Wealth surpassed CITIC Securities, the “leading” securities industry, and has been firmly at the top of the list ever since.

On December 13, the total market value of Oriental Wealth broke 400 billion yuan, and the “ticket mao” once again opened up space for investors to imagine.

Eastern Fortune’s operating income will reach a new level. The financial report shows that in the first three quarters, Oriental Fortune achieved operating income of 9.64 billion yuan, a year-on-year increase of 62.1%, which is only a short walk from the ten billion mark. Net profit attributable to the parent increased by 83.5% year-on-year to 6.23 billion yuan, a growth rate far ahead of traditional listings. Brokerage.

According to the data disclosed by the China Foundation Association, as of the end of the third quarter, the holding scale of Oriental Fortune’s Tiantian Fund’s stock + hybrid public offering fund reached 484.1 billion yuan, which is the fastest growth rate compared to the previous month. In the near future, it will challenge the champion and runner-up China Merchants Bank and Ant Fund, and Ant is regarded as a real “rival” by Eastern Fortune.

As the market value of Oriental Wealth continues to rise, the actual controller and chairman of the board (formerly known as Shen Jun) are getting more and more pockets.

According to the 2021 Forbes Mainland China Rich List, the family ranked 38th with 85.7 billion yuan, closely behind the former richest man Wang Jianlin (94 billion yuan) and Haidilao Zhang Yong’s family (90.2 billion yuan).

4. Jitu: The Rise of Low-priced Catfish

While holding on to the “thighs” of Duoduo, and rapidly expanding the scale with the help of the development of China’s e-commerce market, it continued to “absorb money” and won a total of about 4.05 billion yuan in financing. In this way, Jitu Express, which entered the Chinese market for less than two years, stirred up a new round of price wars and caused misfortunes for its opponents, which once triggered government regulators to stop it. However, the news of Jitu’s new financing continues, and each time it means that Jitu’s “ammunition” is more sufficient. With the help of these “ammunitions”, the average daily order volume of Jitu has stabilized at around 25 million orders, and it has become the mainstream of domestic express companies. The current industry price war has seen an inflection point at the beginning, and the advantage of Extreme Rabbit has also weakened. Just as the industry speculated on what will be the next step for Jitu, Jitu once again dropped a “bomb” to the industry-the 6.8 billion acquisition of Best Express, and the delivery was completed on December 17. Since then, the integration of the two networks of Best Express and Jitu will become the focus of the industry, and it will also be a standard for testing the value of 6.8 billion yuan. The fast-moving Super Rabbit doesn’t just want to rely on Best Express to win the second half. At a symposium held by the State Post Bureau in early December, Fan Suzhou, CEO of Supertuple Express, said that the focus of the future is not only to integrate Best Express and Supertuple, but also to promote the return of reasonable prices. In addition, how to improve service quality, develop diversified businesses, make a long-term layout, and maintain sufficient funds are also required “courses” for Jitu in the second half of the competition. In the first half of Extreme Rabbit, it relied on fighting a lot, e-commerce dividends, and even more relied on the courage to spend money. But in the second half of the polar rabbit, there were still many question marks.

5. SAIC-GM-Wuling: Redefining small electric vehicles

As of November this year, SAIC-GM-Wuling’s cumulative global sales reached 1,444,441 vehicles, a year-on-year increase of 6.31%. The continued hot sales of new energy products also brought SAIC-GM-Wuling’s global sales to another dimension. To put it in an intuitive way, the global sales growth record of this Chinese automaker is refreshed every 30 days.

Statistics from EV Sales, a global market research organization, show that as of October this year, Wuling Hongguang’s cumulative sales of MINI EV models reached 328,000, ranking second in the world after Tesla Model 3 models. In November of this year, this model has become the sales champion of China’s new energy vehicle market for 15 consecutive months with sales of 45,576 units, with an overall sales volume of more than 500,000 units.

Behind the hot sales of Hongguang MINI EV, the Global Small Electric Vehicle Platform (GSEV) independently developed by SAIC-GM-Wuling plays a key role. The platform is considered to redefine small electric vehicles from the perspectives of space, safety, energy consumption, energy supply and services.

In addition, the arrival of this car seems to activate the soul switch of SAIC-GM-Wuling at the marketing level. From the launch of Hongguang’s MINI EV Macaron version, to cooperation with Station B, Disney and many art groups, from fashion circles to ordinary amateurs, SAIC-GM-Wuling has become synonymous with “fashion” today. Wuling Hongguang MINI EV has gone beyond the scope of transportation tools and transformed into a part of fashion wear.

All this is attributed to the fact that SAIC-GM-Wuling has integrated the thinking of contemporary young people’s life preferences into the vehicle production and sales business. While fully meeting the travel needs of low-budget car buyers, it has brought additional added value to it.

Judging from the current business situation, SAIC-GM-Wuling will provide a phenomenon-level topic for the auto market in 2021 in terms of global sales, and there is basically no suspense.

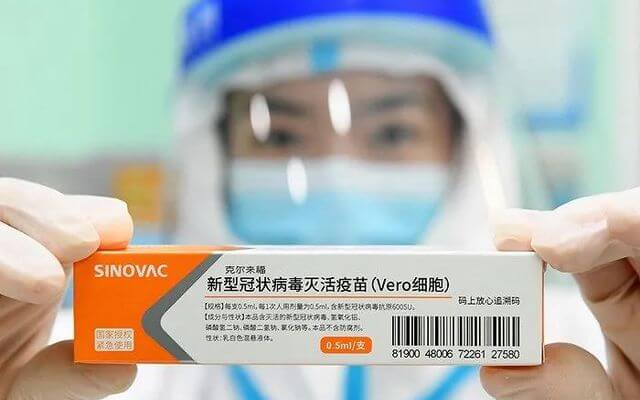

6.SinoVAC: The COVID-19 vaccine manufacturer with the largest supply and usage in the world

From a commercial point of view, relying on the sale of COVID-19 vaccines, SinoVAC’s performance during the year is very good. According to the previous semi-annual report of China Biopharmaceuticals, SinoVAC’s net profit in the first half of the year was about 50 billion yuan. In other words, the company’s annual profit level will touch the scale of 100 billion yuan.

On November 20th, SinoVAC released its latest global supply and vaccination data through the official WeChat platform “Vaccine Benefits”. As of that day, SinoVAC has supplied more than 2.2 billion COVID-19 vaccines to the world (including China). It is the COVID-19 vaccine with the largest supply and use in the world and China.

7. Anta: The rise of domestic products, once surpassing Adidas

Taking advantage of the dividends from the Tokyo Olympics and the 2022 Beijing Winter Olympics, in the first half of 2021, Anta Group’s revenue increased by 55.5% year-on-year to 22.81 billion yuan. In the middle of the year, the market value of Anta Group once surpassed Adidas and became the world’s second largest sportswear group.

The digital transformation strategy of global sports brands is also an important engine for Anta to grasp the dividends of online traffic this year. During the 11.11 period, Anta Group focused on the core strategy of “making explosive products deeper and bigger”, ranking first in the industry for the first time in the total turnover of Tmall sports outdoor shoes and clothing and maternal and child shoes, and the accumulated turnover of e-commerce. Over 4.65 billion yuan, a year-on-year increase of 61%.

In the category of sports shoes and apparel, Anta continues to rank first among domestic brands, and together with its FILA brand, it has two positions in the top five sports brand sales.

In July 2021, Anta announced the latest plan for the main brand: In the next five years, the Anta brand will achieve a compound annual growth rate of 18-25%; online business will grow at a compound annual growth rate of more than 30%, and the proportion will reach 40% in 2025; overall The market share will increase by 3-5 percentage points and maintain the leading position of China’s sports brand.

8. Northern Rare Earths: The global leader in rare earths with minerals at home

With the rapid development of the new energy industry, the penetration rate of rare earth permanent magnets in industries such as wind power, new energy vehicles, industrial motors and inverter air conditioners has continued to increase, which has driven the demand for upstream rare earth products to soar. Just like lithium and cobalt, the new energy properties of rare earths have also continued to strengthen, and the industry’s supply and demand pattern has ushered in an inflection point this year, opening a new round of prosperity and a new cycle.

As the world’s largest supplier of rare earth products, Northern Rare Earth (600111.SH) relies on its controlling shareholder to control the exclusive mining rights of the world’s largest rare earth mine-Baiyun Obo Mine, and has become the biggest beneficiary behind the industrial boom.

In 2021, Northern Rare Earth will receive a total of 100.4 million tons of rare earth mining quotas, accounting for about 60% of the national total. This quota is about 7 times that of the China Rare Rare Earth Group and 3 times that of the Southern Rare Earth Group.

Riding on the east wind of new energy, the prices of North Rare Earth products have also been rising. The listed prices were sold at the alarm price (the highest price that can be bid on that day) thirteen times during the year, and the prices of some products hit a 10-year high.

Benefiting from the rising volume and price, the performance and stock price of Northern Rare Earth have soared this year. In the first three quarters, the total revenue of Northern Rare Earth reached 24.091 billion yuan, a year-on-year increase of more than 50%; net profit reached 3.149 billion, a year-on-year increase of nearly five times; the stock price hit a record high of 62.1 yuan per share, about 4.7 times the beginning of the year.

The domestic rare earth industry is accelerating its integration. China Minmetals, Chinalco and Ganzhou Municipal People’s Government are planning to establish a China Rare Earth Group with medium and heavy rare earths as the mainstay, in order to further increase the market concentration of the rare earth industry.

After the establishment of the new group, it will occupy half of the industry with the northern rare earths, forming a new pattern of the rare earth industry with one south and one north, and the south is more important than the north. Can they take up the important task of increasing China’s voice in the international rare earth market?

9. Ganfeng Lithium: The attacking giant in the upstream of lithium battery

With the explosion of the lithium battery industry this year, the supply-demand relationship of lithium resources has become tight. The price of battery-grade lithium carbonate has exceeded 230,000 yuan/ton, a year-on-year increase of more than four times.

In the first three quarters of this year, Ganfeng Lithium (002460.SZ) achieved a net profit of 2.473 billion yuan, a year-on-year increase of 6.5 times.

Starting from the middle reaches of lithium salt, Ganfeng Lithium continues to extend to the upstream and downstream of the industrial chain. Currently, it has 8 mineral resources, 12 major production bases, and 2 R&D centers around the world.

At the beginning of its establishment in 2000, Ganfeng Lithium mainly focused on lithium salt processing in the middle reaches. It has formed an annual production capacity of 43,000 tons of battery-grade lithium carbonate, 81,000 tons of battery-grade lithium hydroxide, 2,000 tons of metal lithium, 500 tons of butyl lithium, and 1,500 tons of lithium fluoride.

The expansion of lithium salt production capacity will continue. The company plans to form a lithium product supply capacity with a total annual output of not less than 200,000 tons/year of lithium carbonate equivalent by 2025, and in the long term, it will form a lithium product supply capacity of not less than 600,000 tons/year of lithium carbonate equivalent.

For upstream lithium resources, the company has shown greater ambitions. After ten years of planning and competition from 2011 to the present, it has owned the Marion and Pilgangoora spodumene projects in Australia and the Cauchari-Olaroz salt lake project in Argentina. These three projects have excellent resource endowments and are the cornerstone of their resource reserves.

But it is not reconciled to this. This year, it has started the all-round seizure of lithium resources. It has successively acquired Yiliping Salt Lake, Mali Goulamina Lithium Mine, and Canadian Millennial Corporation.

As of the first half of the year, the company’s equity lithium resources reached 26.11 million tons of lithium carbonate equivalent, ranking first in China and the world.

Ganfeng Lithium is also accelerating its exploration of profitability in downstream businesses. From July to August this year, its subsidiary Ganfeng Lithium Battery successively reached strategic cooperation intentions with Dongfeng Motor, Batry, JinkoSolar, etc. The scope of cooperation covers automotive power batteries, solid-state battery development, photovoltaic energy storage applications, and waste lithium battery integration. Recycling and other fields.

10. China Shenhua: The net profit of the most profitable coal company soars

Since the beginning of the year, coal prices have soared, and eventually jumped to more than 2,000 yuan/ton, which is more than three times the average price of last year. As the country has made several moves, coal prices have turned around since the end of October, but they are still in a high range.

As the largest listed coal company in China, China Shenhua (601688.SH) has always been the most profitable coal company in China. In the first three quarters of this year, the company’s cumulative commercial coal output was 278 million tons, an increase of 4.4% year-on-year; the cumulative sales of coal was 431 million tons, an increase of 7.8% year-on-year. Revenue reached 2329 in the same period 449 million yuan, a year-on-year increase of 40.2%; net profit attributable to listed shareholders was 40.751 billion yuan, a year-on-year increase of 21.4%. This is the first time that its net profit has broken the 40 billion yuan mark in the same period since its listing in 2007.

China Shenhua was established in 2004 and belongs to the National Energy Group, one of the five largest power generation groups in China. As of the end of 2020, the company’s assets reached 558.4 billion yuan.

In addition to the main coal business, China Shenhua has also deployed power, railway, port, shipping, coal chemical and other sectors. All along, the company’s most praised in the industry is this integrated business model, which is also the guarantee of its profitability.

In 2017, the former Guodian Group and the former Shenhua Group merged to form the current National Energy Group. As a core listed company, China Shenhua’s coal-fired power assets have also been greatly improved, highlighting the advantages of integration.

11. Baosteel: the beneficiaries of mergers and reorganizations

In September of this year, Baosteel’s stock price once reached a historical high of 11.56 yuan, with a market value of more than 250 billion yuan. Although the stock price fell in the later period, it is still the steel company with the highest market capitalization among A-share listed companies.

The steel industry has experienced a process from explosive to calm this year. Because steel prices hit a 10-year high in the first half of the year, even if they fall in the later period, steel companies still have outstanding performance this year.

The automobile industry is Baosteel’s most important downstream market, and the company occupies more than half of the domestic automobile steel plates. In the first three quarters of this year, China’s auto production was 18.243 million, a year-on-year increase of 7.5%, which provided the basis for the company’s performance growth.

Baosteel is backed by China Baowu Group, the world’s largest steel company.

China’s steel industry is moving from fragmentation to integration. In recent years, China Baowu Group has successively absorbed enterprises such as Wuhan Iron and Steel, Maanshan Iron and Steel, Bayi Steel, Shaoshan Iron and Steel, Chongqing Iron and Steel, Egang, Taiyuan Iron and Steel, and ranked first in the world with 115 million tons of crude steel output last year. Scale advantages and discourse Power will be further enhanced. Baosteel Co., Ltd. will be the beneficiary of this wave of industry mergers and reorganizations.